Executive Summary

April 15, 2004

The City of Branson wants a transit system because of it’s traffic congestion in the east Hwy 76 entertainment area of town. This road is too narrow to carry the volume of traffic that has sprung up from building all the theaters. In a town of 7,000 population, there are 49 theaters with 62,000 seats These theaters attract over 7 million visitors in 300 days of the year, resulting in an average daily visitor count over 23,000 with peaks near 100,000. Traditional transit such as busses and light rail won’t work because they will get caught in the same congestion and move at the same pace. Last summer, the City has requested an RFQ to see who has what kind of technology and what experience. Last fall the City engaged a Missouri firm to study the ridership and alignment.

Financing is the Issue

There are many forms of elevated technology that could work, but technology is not the issue, financing is. Federal funding is doubtful because there are 100 cities in line ahead of Branson and the feds only fund light rail. State funding is also doubtful because there are larger urban area with more powerful voices that can’t get it either. So Branson will have to come up with the financing on its own. There are three choices:

1. Municipal Funding thru General Obligation or Revenue Bonds

2. Tourism Improvement District funding using sales or property taxes

3. Franchise funding syndicated among local and national investors

All the above alternatives will require a public vote to approve using the public Right-of-Way and the financing plan. In General Obligation Bonds (1) property owners throughout the city will be on the hook for collateral. Revenue Bonds will only use the installed system as collateral and draw a higher interest rate. The Improvement District (2) will be collateralized by increased taxes on the businesses that benefit from the tourists such as theaters, hotels, amusements, retail and restaurants. The franchise (3) will provide it’s own collateral from third party investors expecting to earn a profit.

Automated Guideway Transport (AGT)

Smartskyways is a collaboration

of transport-experienced individuals that are proposing an AGT that can be

constructed for about $15 million per mile on long routes and $15 million or so

on short routes. We believe our AGT can operate with such efficiency (no

drivers) that a profit will result in each of the above financing alternatives.

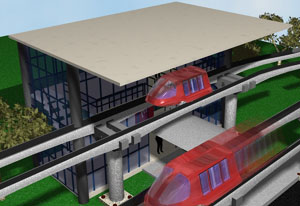

Smartskyways version of AGT operates like an Interstate Hwy with off

line docking and high through put to the riders final destination. It switches

from the main line to station ramps. Stations are two stories and contain,

ticketing and vending machines, elevators, seating, water, lockers, telephones

and space for two vehicles: one space to load up front and one to unload

behind. When unloading is finished, this car moves to the loading position. The

entire system is electric and the cars pick up their power from the guideway to

run 100 hp electric motors.

Smartskyways version of AGT operates like an Interstate Hwy with off

line docking and high through put to the riders final destination. It switches

from the main line to station ramps. Stations are two stories and contain,

ticketing and vending machines, elevators, seating, water, lockers, telephones

and space for two vehicles: one space to load up front and one to unload

behind. When unloading is finished, this car moves to the loading position. The

entire system is electric and the cars pick up their power from the guideway to

run 100 hp electric motors.

Development Issues

Branson’s Highway 76 is a very tight corridor to put

anything else into. It has only one lane of traffic in each direction with a

turning lane in the middle as shown to the right. The sidewalks are narrow and

will have to be widened in order to support more pedestrian traffic. The columns

will disrupt traffic if they are put into the street. As they are only 50 feet

apart, it would be difficult for cars and fire engines to turn from the center

lane. It makes more sense to put them on the sidewalk. But the side walks are

where most of Branson’s utilities are located. Which side gets them will be an

issue because at 18 feet high they will block some of the signage that was

built for cars. About 30 signs will have to be moved as a part of the project.

And over 100 telephone and power and street light poles will need to be moved.

How the other side of the street gets access to the AGT traffic will also

become an issue. Pedestrians crossing the street will be a problem and at

stations traffic lights will be needed. Much work will have to be done with

the property owners to get them to agree. The users will include a large

percentage of elderly who need elevators to access the elevated boarding areas.

This is included in the costs. There should be a 12’ wide sidewalk directly

below the guideway for the pedestrian traffic between stations. This can be

enhanced with kiosks, seating, landscaping, water fountains, signage and even

street vendors. It will need many new curb cuts and parking spaces

Branson’s Highway 76 is a very tight corridor to put

anything else into. It has only one lane of traffic in each direction with a

turning lane in the middle as shown to the right. The sidewalks are narrow and

will have to be widened in order to support more pedestrian traffic. The columns

will disrupt traffic if they are put into the street. As they are only 50 feet

apart, it would be difficult for cars and fire engines to turn from the center

lane. It makes more sense to put them on the sidewalk. But the side walks are

where most of Branson’s utilities are located. Which side gets them will be an

issue because at 18 feet high they will block some of the signage that was

built for cars. About 30 signs will have to be moved as a part of the project.

And over 100 telephone and power and street light poles will need to be moved.

How the other side of the street gets access to the AGT traffic will also

become an issue. Pedestrians crossing the street will be a problem and at

stations traffic lights will be needed. Much work will have to be done with

the property owners to get them to agree. The users will include a large

percentage of elderly who need elevators to access the elevated boarding areas.

This is included in the costs. There should be a 12’ wide sidewalk directly

below the guideway for the pedestrian traffic between stations. This can be

enhanced with kiosks, seating, landscaping, water fountains, signage and even

street vendors. It will need many new curb cuts and parking spaces

Some Unanswered Questions

The reason for such a large contingency fund in our budget is from the unanswered questions about these costs below.

1.

Will the city provide some or all ROW and/or

easements without cost?

2. Will the

city use eminent domain powers to acquire private land needed for ROW?

3. Will the

city pay for any utility relocation that might be necessary?

4. Will the

city require an emergency walkway on all elevated guideway sections?

5. Will the

developer be able to finance part of his costs with bonds?

6. Will

there be any joint public/private land development to help finance the project?

7. Will a

performance bond be required from the developer?

8. Will the city agree to rezone (up) some land as part of their contribution to the project?

9.

Who

will pay for the new sidewalk under the guideway?

10. Branson

Transit Report (Travel

Demand Analysis – Ridership

Technical Memorandum)

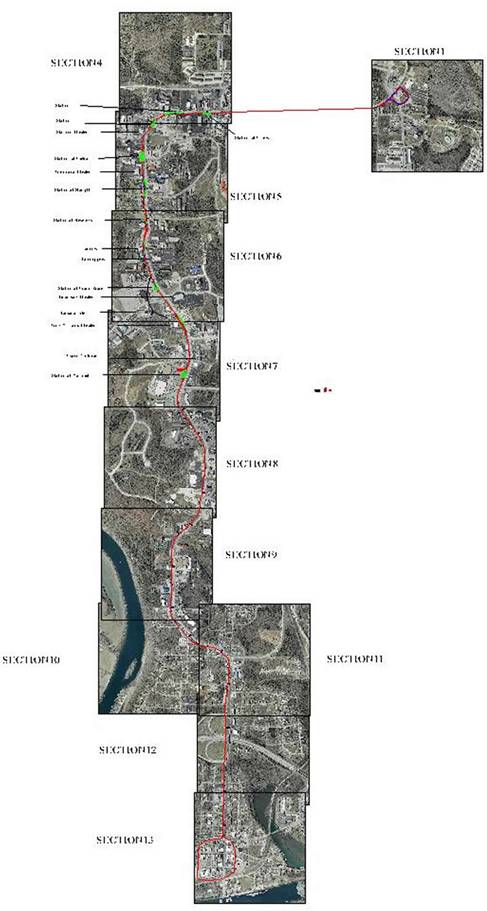

Initial Route Layout

A 5 mile route from downtown new convention center to the west end of the theater district along Highway 76 is what the city wants as shown in Exhibit A. It will provide AGT access to the majority of theaters, amusements, malls, some hotels and restaurants serving the Branson tourism industry. But many hotels are located on the yellow route south of Highways 76. Open-air trams serving as a collector distributor to the AGT loop at each end, can serve this route. The majority if not all tourists will spend the night at a hotel and that is where we get them out of their cars and turn them into pedestrians using our Skyways AGT for circulation. Hotels can issue a boarding card paid for as a part of the room at $2.00 per day for unlimited ridership. As a comparable, the new Las Vegas Monorail will charge $10 per day for unlimited ridership. If needed, theaters, amusements, retail and restaurants can pay their share with an equivalent sales tax added on to the price of their service. Over the 5 miles route, 25 stations would be 5 per mile. This would require a maximum walk of 600 feet to a station. But some business owners may prefer to have stations come right into their buildings. We can accommodate this, if they pay for the extra ramp footage and docks. There are so many attractions along the route that more stations may be desirable. A stations could be across the street. This will mean some ramps may have to cross the street and leave an occasional column footprint in the turning lane. Such locations will be tricky, but can be done. This will require a lot of individual negotiating with the city.

Economic Feasibility

Assuming the 5 mile route will costs $70 + million for the basic construction there are additional costs to be considered that could add up to a total estimated costs of about $88.5 million for planning purposes. These additional costs include, moving power lines and signage, relocating some driveways & curb cuts and building stations with elevators or escalators. The $88.5 million figure also includes $ 5 million interest escrow for the early years, 15% for engineering and a 10% construction contingency. Assuming an $88.5 million financing at 6% interest and $2 per day per passenger for unlimited rides, it requires 12,700 riders per day to breakeven, or 42% of 30,000 visitors per day as riders. But the convention center project estimates it will add another 4.5 million visitors per day when completed in 3 years. This includes about $350 million for a hotel and an entertainment type of shopping center. Annual operating costs are assumed at 30% + 3% for replacement. Using an annual growth factor of 3% in both ticket pricing and ridership, the project will generate cash flow profits in excess of costs over 25 years of $263 million (before any taxes). With 12,700 riders per day to start, the project earns $36 million after debt in the first 10 years and if sold then, appreciation profit is also possible.

Expansion Route

Once the initial ridership proves the operational revenues are high enough, an 8+ mile expansion route that picks up most of the outlying hotels can be organized and funded. This may take many years as this expansion route will not generate as much additional revenue as the initial route and will have to depend on the initial route for some of it’s revenue. But the development of a downtown convention center will make a huge difference and over time there is more room to build along this expansion route. So it will attract the new theaters, hotels, amusements, retail and restaurants that serve the tourism industry too. It will also attract retirement housing as Branson is a great place for retirees with all these activities.

Impacts

Such an AGT project will cause many changes in the community

including land uses, visuals, traffic, economics and growth. Branson must be

prepared for the international attention and outside interest this project will

create in their community. Land values will rise, growth will be faster,

tourism will increase and more investment will flow in. Properly channeled this

can be a good thing for most of the population. But it will require more

planning to control, otherwise it could get out of hand. One of the impacts

that is sure to result is condominium development around the station stops

especially in an expansion route where there is more undeveloped land. The city

can organize this into mixed use pedestrian villages that appeal to the

retirement market. There is over 2 million s.f within a 2 block walk of

stations as shown right. Most of the theaters have huge parking lots that can

accommodate development.

Such an AGT project will cause many changes in the community

including land uses, visuals, traffic, economics and growth. Branson must be

prepared for the international attention and outside interest this project will

create in their community. Land values will rise, growth will be faster,

tourism will increase and more investment will flow in. Properly channeled this

can be a good thing for most of the population. But it will require more

planning to control, otherwise it could get out of hand. One of the impacts

that is sure to result is condominium development around the station stops

especially in an expansion route where there is more undeveloped land. The city

can organize this into mixed use pedestrian villages that appeal to the

retirement market. There is over 2 million s.f within a 2 block walk of

stations as shown right. Most of the theaters have huge parking lots that can

accommodate development.

Land Owners Option To Purchase

The landowners could stymie the development of such a system, if they don’t like the overhead technology or some taking of their property. In order to induce them to participate, Smartskyways will offer them an option to purchase the route within 5 to 10 years with a Tax District (to be formed). This same tax District could also pay for the sidewalk ‘Mall” Within 5 years the revenue stream should be proven and they will know what they are buying. A purchase price can be negotiated before construction. If after 10 years the, landowners don’t buy, then the route will be offered to the City of Branson to purchase. If the City doesn’t purchase within another year, the investors will be free to sell to any third party.

Public Vote

All the terms of a Franchise for this 5 mile Route can be approved by public vote including a specific ROW, financing plan, technology, landowners option and management team. Any infrastructure that can win a public vote can be financed one way or another. The front-end costs leading up to the public vote are the most difficult to generate. Assuming the cost of the vote is included in a normal election, we estimate $500,000 minimum will be necessary to prepare the information needed for a public vote, but we are budgeting $1,200,000 in Branson to be sure. In Tax Districts and other kinds of bond-funded projects, the front-end costs can often be reimbursed after the public approval.

The vote to approve a franchise will also define the powers, liabilities and governance. A plan will be filed with the City 60 days before a vote furnishing all the details that have been negotiated over the ensuing year with landowners, investors and the City.

Exhibits

The

route map is shown below on the next page. This hyperlink goes to greater

detail on our web site. http://www.smartskyways.com/Technology/route/2-Missouri/Branson/BransonRoute.html

Exhibit A