Investment in Real

Estate

1. Summary

|

Branson Meadows is a part of a 400 +/- acre land assemblage we have been working with to locate the ¼ mile Model. As it is improved development ground, we would like to purchase as much land as possible, up to $40 million for packaging and sales of transit villages. Estimated return to investors, if we just wholesale the land, is $64 million. However if we develop one of the Villages for $30 million in additional capital, an additional $35 million profit is estimated. The only village we may want to build is the Retirement Village because it is driven by presales, built in modules and marketed to the 77 million “Baby Boomers” soon to retire. We are offering to take a 25% profits interest for management and the funders own it all. |

|

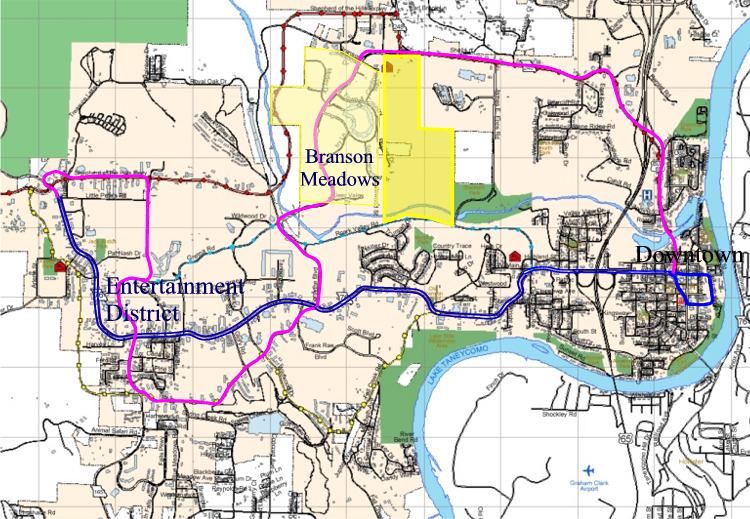

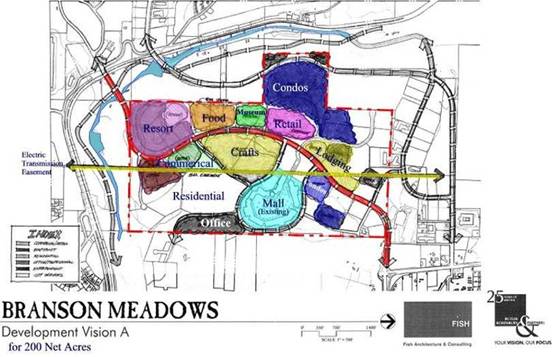

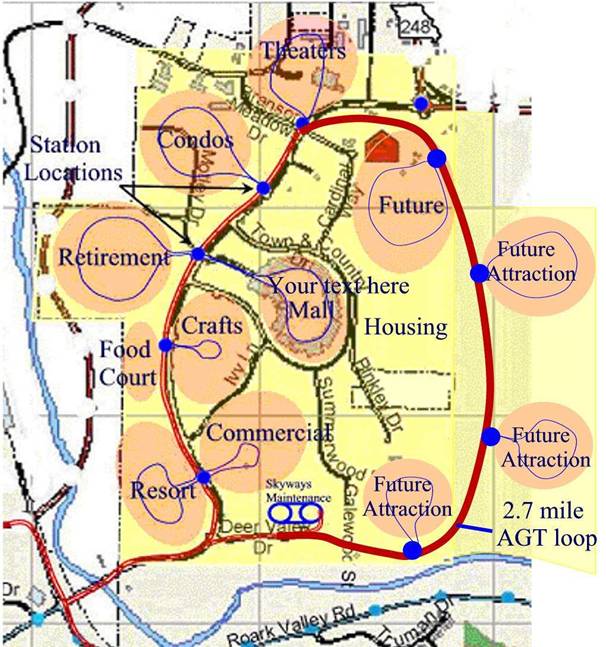

2. Location of Branson Meadows (in yellow)

|

Branson Meadows is the largest parcel of undeveloped but

improved land inside the city limits and lies strategically between the 5 mile Entertainment District loop shown in dotted red line above and the 7 mile future Loop connecting to downtown and the proposed Convention Center. |

3. Description of Branson Meadows

200 acre Master Planned Community between downtown and entertainment district

Zoning -Currently is mixed use and requires Plat

60’ Easements for Power lines runs north and south

Existing Debt not known yet

First Deed is not known

Comparables: Land values on the strip run from $12 to $20 psf and most sites will require the tear down of existing structures.

Existing Improvements worth $17 million are already installed for roads, bridge, utilities, signage, lighting and other infrastructure.

|

|

|

|

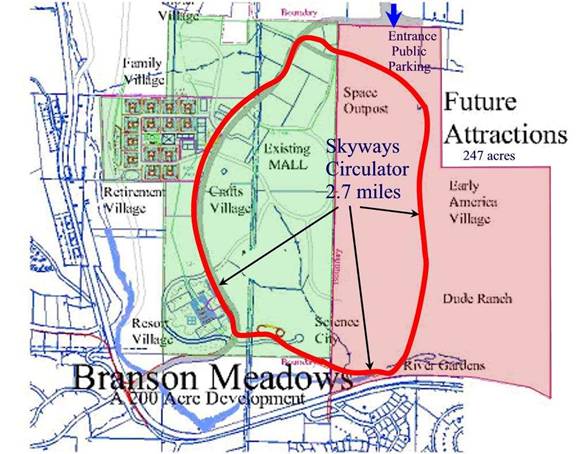

| Current Master Plan showing 4 lane divided Parkway in dashed red going thru middle of site. The yellow line is a high powered transmission easement 60 wide running north and south. |

4. Real Estate Investment Breakout

Cost to Assemble

147 acres at $1.56 psf $10 mil 22 Resort acres at $ 15psf $14.3 mil

247 acres $12 mil Retirement Village 50 ac @5p $10.9 mil

Rezoning, fees and Platting $02 Mil Family Village 50 ac @ 5psf $10.9 mil

Existing Mall $16 mil 272 remaining acres $5 psf $59.2 mil

$40

mil Mall at

$125 psf $37.5

mil

$133

mil

Net Sales Revenue

(less 5% over head and marketing) $126 Mil

Net Operating Income $ 86 Mil

There is an additional Option for $30 Million to begin constructing

Some of these funds can be used to package the

Terms of funding

- 100% ownership of all assts

- management earns 25% profits interest

- Will deploy additional $40 Million within 90 days

5. Existing Mall for $16 Million

| Not part of Branson Meadows ownership. 30 Shops built in mid 90s for tourist market and owned by 3rd party REIT. This mall attracts tourists to Branson Meadows already. Some of the existing shops are Mountain Man Fruit, Dress Shop, Leather Shop, souvenirs with a tourist orientation. |

|

|

|

|

|

|

|

|

| The existing

Mall of 300,000 sf has been sold as part of a $3.5 Billion package to Simon and

Co. the largest Mall owner/builder in |

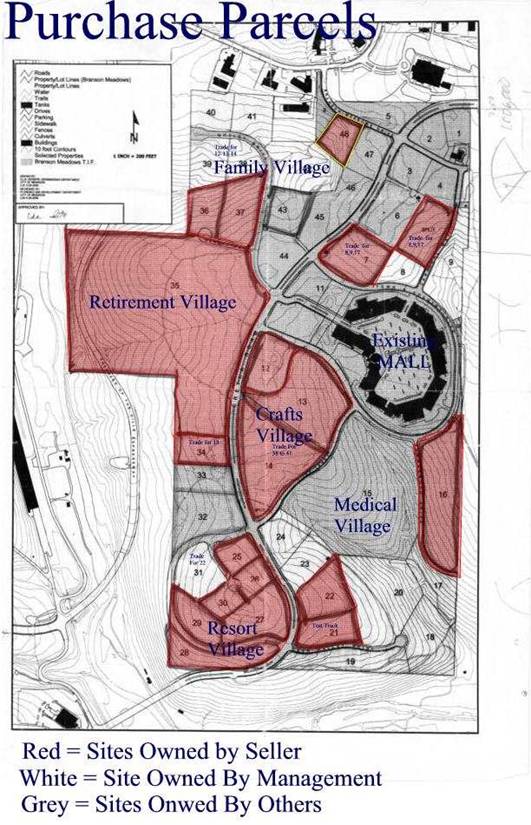

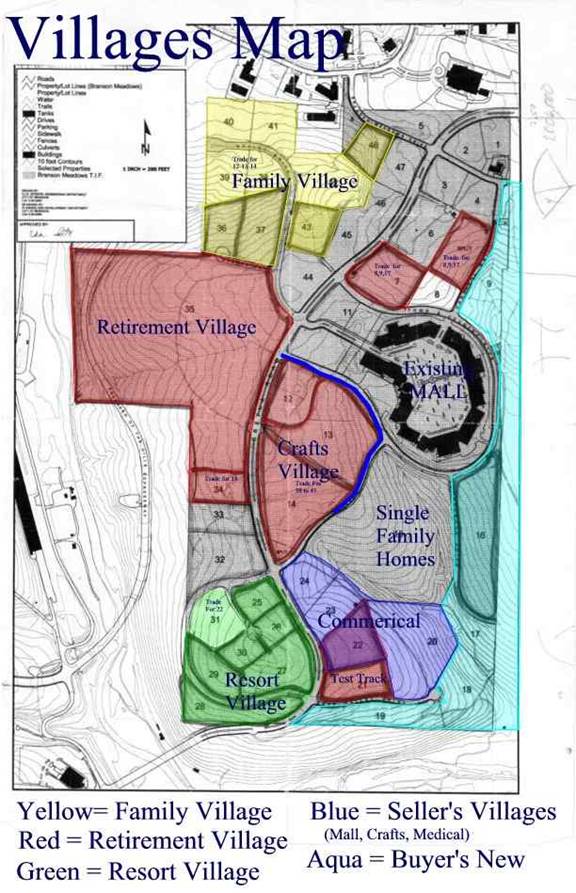

6. A $10 Million land Purchase

| The red parcels shown on the following page is the key to

this assemblage. These parcels contain 147 acres and have utilities already to

the site along with roads, landscaping and street lighting at the entrance to

each. Because the owners have begun to fight among themselves, we now believe

these parcels may be purchased close to $10 million, which is about $1.56 psf.

There are three villages contained in this purchase, which are shown in the

Village Map below. A little trading with the owners will provide a Retirement Village-50 ac, Family

Village- 50 ac and a |

These are the parcels that

in seller’s $10 million price. They come to 147 + acres.

Colors below show the trades necessary to assemble

Villages under single ownerships.

7.

|

We met with the owner of adjacent land to the east. It is bounded by SOH parkway on the North and the river road on the south. It is raw land with no roads or utilities. They do not have a price on it at present. I have suggested to them that they get it appraised and then we discuss a purchase. If we appraised it first, I think a $1.12 psf price might be possible with a prompt closing. What ever the price, this would give us about a 400 acre assemblage that could appeal to national developers. A Smartskyways loop as shown below, will link this property to the entertainment district, Branson Meadows and downtown. Such a loop would be about 2.5 miles. It’s costs of $37.5 million could be paid for with Tax Increment Financing (TIF) and just approval for this loop should increase the land value above $5 psf. The 247 aces on the east side could be planned for a series of attractions as shown above that could exceed one billion dollars of development potential. This large site combined with a local loop that connects to 12 million planned visitors on Route 76 could attract many national development companies |

$2,000,000 in working capital could control more than

$1.5 billion worth of development on this assembled site.

At 400 +/- acres and .5

Floor Area ratio means 8.7 million sf of construction

8. A One

Mile AGT Extension will connect this 400

acres to Route 76.

|

By installing this 1mile, we create the equivalent of being on Route 76 where the action is and to downtown, and in fact most of the town. People visiting or owning property at Branson Meadows would not have to drive their car and yet are accessible to everything. This AGT extension creates an opportunity to recast Branson Meadows as a series of “Transit VILLAGES”. This project represents an opportunity to show how real estate is impacted by AGT access. At the same time, the AGT system gives instant access from the Entertainment District to the Villages for pedestrians. Each village can also have a golf cart pathway collecting and distributing passengers to their final destination. It is our contention this will significantly increase the values of these properties. |

9. Proforma for $70

+ Million in Real Estate Investments

| The table below is a simple illustration of increasing land values with AGT access and connection to Route 76.

The Village pricing table below estimates the values created from the $40

million allocated to assembling real estate and an optional $30 to 40 Million

construction proforma for the |

|

Land Sales Feasibility |

|||||||

|

|

|

|

July-04 |

|

|

|

|

|

|

|

$40 Mil min & $80 Mil max over

5 years |

|

|

|||

|

|

|

|

conservative |

expected |

attainable |

|

|

|

Income

|

|

|

|

|

|

|

|

|

|

33.4 |

60.2 |

87.2 |

|

|

||

|

|

|

9.6 |

14.4 |

19.2 |

|

|

|

|

Family

Village-50 acre land (5, 15, 20 pas) |

|

10.9 |

16.3 |

21.7 |

|

|

|

|

Misc

sites -10 acres (2.50-5.00-7.50psf) |

|

|

10.8 |

21.7 |

17.4 |

|

|

|

Remaining

247 acres (3,5,7psf) land only |

|

|

32.2 |

53.8 |

75.2 |

|

|

|

Total Income |

|

|

96.9 |

166.4 |

220.7 |

|

|

|

|

|

|

|

|

|

|

|

|

Costs |

|

|

|

|

|

|

|

|

Less

Purchase of 147 acres |

|

10.0 |

10.0 |

10.0 |

|

|

|

|

less

Purchase East 280 acres |

|

12.0 |

12.0 |

12.0 |

|

|

|

|

Less

Existing Mall |

|

16.0 |

16.0 |

16.0 |

|

|

|

|

Less

Admin, planning, marketing and overhead |

|

2.0 |

2.0 |

2.0 |

|

|

|

|

Sub Total |

|

|

40.0 |

40.0 |

40.0 |

|

|

|

|

|

|

|

|

|

|

|

|

R. E. NOI

(Before tax) |

|

$56.9 |

$126.4 |

$180.7 |

|

|

|

ROI (75%) on $70M over 4 years 15%py 33%py 48%py

10. Retirement

Village

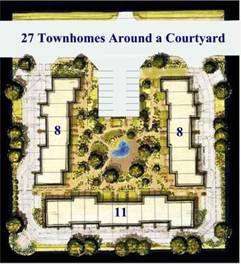

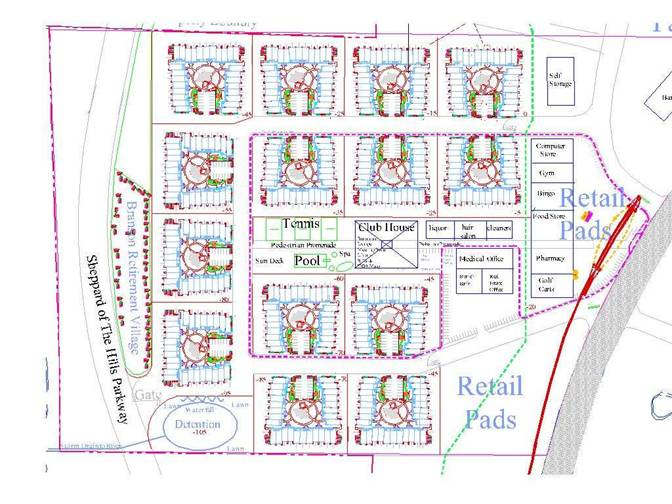

| This is a 378 Townhome layout using 14 PODs. Each one contains 27 residential units (PODs) built around a garden courtyard. The green shown below represents Commons Area Amenities and the blue represents supporting retail such as liquors, cleaners, bank, RE Office, hair salon and medical. Closer to the station is food store, pharmacy, Bingo, computer and a golf cart shops. There are 77 million baby boomers that will begin retiring soon and Branson is a lively, entertaining and interesting place to live. The proforma below shows the profit potential of building the first half with a $30 Million optional investment, then rolling over the profits to continue building until project competition. Some of the Village will be a mix of retail and office services that retirees need such as liquor , cleaners, hair saloon, branch bank, food , pharmacy, computer, medical, real estate and bingo. In addition this project is large enough to afford recreational amenities such a pool/spa tennis and clubhouse. These are all connected with a 25’ wide mall that runs thru the amenities and store for the length of the Village to the transit station. |

A 27 Unit “POD” Built Around a Garden |

|

|

There are many features built into this plan to attract the pricing. It has most of the retail and recreation services needed in the middle along a 25’ wide Pedestrian Mall that connects to the AGT station. It also has a golf cart pathway around the loop street that connects to the AGT station. Users can just leave the golf carts at selected points when they are finished for someone else to use. If the golf cart strays more than a few feet from this path it will quit running, so people wont take them home. |

|

|

|

|

|

|

|

|

|

$30 Million Optional Investment |

|

|

|

Revenues |

Pricing Levels psf |

|||

|

378 Residential Units |

|

$200 |

$250 |

$300 |

|

(at 1000 ea) |

378,000 |

75,600,000 |

94,500,000 |

113,400,000 |

|

12 Retail Condos at 5,000 sf ea |

60,000 |

12,000,000 |

15,000,000 |

18,000,000 |

|

Future Retail |

100,000 |

20,000,000 |

25,000,000 |

30,000,000 |

|

Gross Revenues Potential |

538,000 |

107,600,000 |

134,500,000 |

161,400,000 |

|

|

|

|

|

|

|

Development Costs |

|

|

|

|

|

Hard Costs |

$psf |

|

|

|

|

Roads and Terracing |

7 |

|

|

|

|

water, sewer, storm, FH |

5 |

|

|

|

|

Cable, phone, Power |

2 |

|

|

|

|

landscaping, irrigation |

3 |

|

|

|

|

Construction of Bldgs |

87 |

|

|

|

|

Commons Areas |

|

|

|

|

|

Clubhouse |

9 |

|

|

|

|

Tennis |

1 |

|

|

|

|

Pool and Sun Deck |

2 |

|

|

|

|

Golf Cart Pathway |

3 |

|

|

|

|

Entry Gates/signs |

1 |

|

|

|

|

Promenade |

2 |

|

|

|

|

SOH Flower Bed |

1 |

|

|

|

|

Soft Costs |

15 |

|

|

|

|

Total Cost (538 x $138) |

138 |

74,244,000 |

74,244,000 |

74,244,000 |

|

without land costs & Interest |

|

|

|

|

|

|

|

|

|

|

|

Net Income (Before tax) |

|

33,356,000 |

60,256,000 |

87,156,000 |

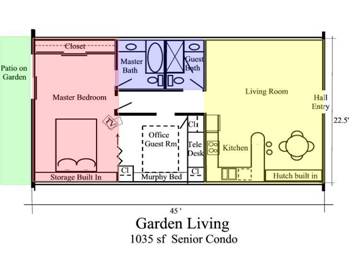

Typical Floor Plan

| Seniors want everything on one level so this layout has 2 bedrooms, 2 baths a kitchen and living area all in 1035 sf. The master bedroom opens onto the garden area. The guest bedroom also doubles as an office with a Murphy bed built in. |

11. The 22 acre

| Development

Theme- Branson is a country western small town that that

exemplifies traditional country values and settings. A Backwoods theme can

convey historical values of the frontier woodsman that settled

|

Resort Site from the top of the hill has commanding southern and western views.

|

|

|

|

Bridge

Entry to Branson Meadows

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||

|

|

Condo

Sales Revenues |

|

$220 psf |

$260 psf |

$300psf |

|

|

|

|

300 Room

Hotel, spac, teleconf, cottages |

|

conservative |

expected |

attainable |

|

|

|

|

522,000

sf including amenities at |

|

114,840,000 |

135,720,000 |

$156,600,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Development

Costs |

|

|

|

|

|

|

|

|

Roads,

Land Grading, walks, curbs, lights |

|

750,000 |

|

|

|

|

|

|

Water,

sewer, storm, fire hydrants |

|

1,500,000 |

|

|

|

|

|

|

Cable,

phone, Internet, Power |

|

250,000 |

|

|

|

|

|

|

Landscaping,

irrigation ,sheds |

|

1,000,000 |

|

|

|

|

|

|

Construction

Costs at $150 psf |

|

|

|

|

|

|

|

|

300 Hotel rooms at 600 sf ave. |

180000 |

|

|

|

|

|

|

|

Restaurant and kitchen |

10,000 |

|

|

|

|

|

|

|

3

Lounges |

12,000 |

|

|

|

|

|

|

|

Lobby |

15,000 |

|

|

|

|

|

|

|

Administration |

5,000 |

|

|

|

|

|

|

|

|

30,000 |

|

|

|

|

|

|

|

Spa and |

15,000 |

|

|

|

|

|

|

|

Back of the House at 15% |

75,000 |

|

|

|

|

|

|

|

50 Cottages on Stream at 600 sf

ea |

30,000 |

|

|

|

|

|

|

|

6 Retail Boxes at 25,000 sf ea |

150,000 |

|

|

|

|

|

|

|

Size of

Total Construction at $150 psf |

522,000 |

78,300,000 |

|

|

|

|

|

|

|

|

1,500,000 |

|

|

|

|

|

|

Underground

Parking 250 cars at$15k ea. |

|

3,750,000 |

|

|

|

|

|

|

4 Tennis

Courts and Club |

|

500,000 |

|

|

|

|

|

|

Fishing

Stream |

|

1,500,000 |

|

|

|

|

|

|

Total

Development Costs |

|

89,050,000 |

89,050,000 |

89,050,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Soft

Costs at 12% of Develop't Costs |

|

|

|

|

|

|

|

|

Insurance |

|

|

|

|

|

|

|

|

Travel |

|

|

|

|

|

|

|

|

Administration |

|

|

|

|

|

|

|

|

Marketing and Sales Fees at 5% |

|

|

|

|

|

|

|

|

Architecture and Planning |

|

|

|

|

|

|

|

|

Engineering and Survey |

|

|

|

|

|

|

|

|

Legal and CPA |

|

|

|

|

|

|

|

|

Office & FFE |

|

|

|

|

|

|

|

|

Total

Soft Costs |

|

10,686,000 |

10,686,000 |

10,686,000 |

|

|

|

|

Land

Costs 22acres at $15psf (what we get) |

|

14,374,000 |

14,374,000 |

14,374,000 |

|

|

|

|

Total

Project Costs (without

land costs) |

|

103,424,000 |

103,424,000 |

103,424,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

Income |

|

$11,416,000 |

$32,296,000 |

$53,176,000 |

|

|

* Assumes

Sale

12.

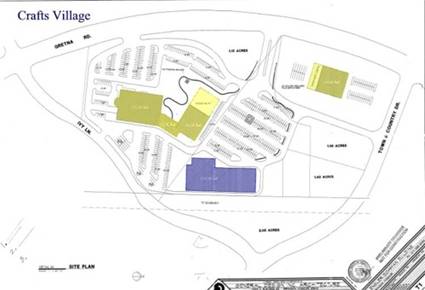

Crafts Village

Being developed by owners of Branson Meadows

| The current owners of Branson Meadows are building 3 buildings with multi tenant lease space. The leasable space is 70% pre-leased with negotiated contracts that have the tenants paying for trash, insurance, taxes, maintenance and janitorial. Three-signed lease have deposits and are participating in the plan below. There is room for 3 times as much development in this village. |

|

|

Development Theme

Branson is a hot bed for such crafts as glass blowing, leather, painting, wood carving, lapidary, jewelry, quilting, furniture, dolls, knives, guns. Branson attracts national artists who both sell and perform in these skills. The Bass Pro shops are an example of mixing Crafts into a retail environment and providing an entertainment factor.

|

|

|

|

13. Existing Lodging

|

174 Room hotel (optional purchase) At this writing, this hotel can be purchased for $2.5 million ($15,000 per room). A local marketing company will guarantee up to $1,000,000 in room rentals per year for a piece of the ownership. Hotels in Branson started as small mom and pop places with cheap rents about 15 years ago. As the tourism traffic has grown, larger hotels and national chains have been building bigger and more expensive lodging. Now to build a hotel on the strip, it requires that existing building be torn down or go elsewhere. This hotel can be acquired for substantially less than replacement costs. It comes furnished and has a pool, lobby, adequate parking spaces and no restaurant. It is currently in operation. |

It could

also serve as Sales office and models for the

Retirement Village

sales.

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||